US dollar struggles to find a floor after non-farm payrolls. A look at upcoming Fedspeak

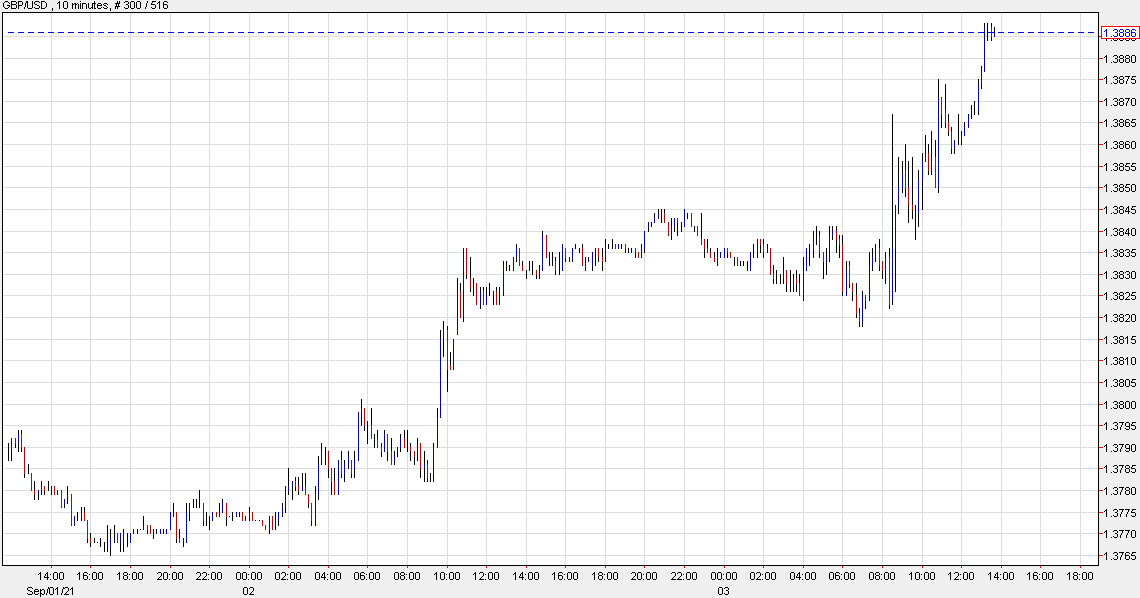

Fresh highs in GBP and NZD

The post-NFP volatility has turned into a slow grind lower for the US dollar and cable (above) is at a new high along with NZD/USD. I think the continuing grind is the right trade but it’s tough to get behind any moves with 3 hours left of trading ahead of a long weekend.

So it’s time to look ahead to next week. I’ll be keying on Fed talk as it’s packed into a three-day window ahead of the blackout period before the Sept 22 decision.

There’s nothing on Tuesday then on Wednesday we get:

Williams is an important one and it will be interesting to hear if there’s more of a climb-down from Kaplan. I usually disregard the Beige Book but commentary about delta, jobs and inflation will be interesting this time around, and potentially market moving.

Thursday:

Bowman is speaking about community banks and we already have a pretty good idea what the rest of the gang will say. Not much to learn here.

Friday:

Mester will speak at a ‘new avenues for monetary policy’ conference. We’ve heard from her lately but she’s a softer taperer and could offer something new. Bullard isn’t actually scheduled to speak but you know that he will find a way onto the airwaves or newswires.