Relative charts suggest bonds and USD outperformance

Can the dollar continue to outperform?

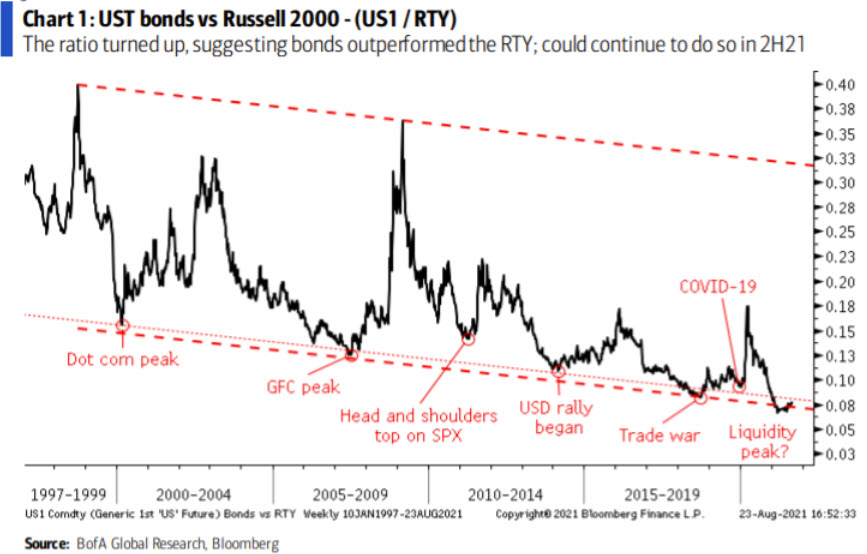

Bank of America Global Research notes that long-term ratio charts suggest UST bonds and the USD are beginning to outperform commodities and Russell 2000.

“In March 2021, the ratio of the US treasury bond future vs Russell

2000 index (US1/RTY) reached a new all-time low, near the bottom of its

20-year trend channel. It has since turned up, making a higher high and

higher low. In the past, when this ratio turned up from such low levels,

it preceded a period when the bond market outperformed the Russell 2000,” BofA notes.

“We see similar evidence that bonds are supported or have

bottomed versus commodities, especially versus oil and copper. Relative

support has also held and/or bottoms formed in favor of the USD indices

versus bonds, Russell 2000, oil and copper. This cross asset conundrum casts a shadow over risk taking in 2H21,” BofA adds.

For bank trade ideas, check out eFX Plus.