Eurozone inflation in focus today

The dollar is slightly on the backfoot ahead of European trading, with slight gains observed in the euro, pound, franc and aussie. Meanwhile, the kiwi is leading gains quite comfortably as New Zealand’s virus situation seemingly being kept under control is spurring RBNZ rate hike bets to come back to the table.

Invest in yourself. See our forex education hub.

As we look towards trading today, month-end is also a factor to be mindful about so keep an eye on things particularly as we get to the London fix later in the day.

For now, it looks like we are seeing calmer risk tones prevail as the market sticks with the post-Jackson Hole narrative with US futures up, Treasury yields softer alongside the dollar to start the new week.

0645 GMT – France Q2 final GDP figures

The preliminary report can be found

here. The final figures should reaffirm a modest expansion in the French economy in Q2 amid the easing of virus restrictions since May.

0645 GMT – France August preliminary CPI figures

Prior release can be found

here. French inflation is estimated to creep higher in August and that should just reaffirm stronger price pressures across the region, a trend likely to persist further in the months ahead.

0755 GMT – Germany August unemployment change, rate

Prior release can be found

here. German labour market conditions should continue to see an improvement over time but it will still take a while to sort out the impact of the Kurzarbeit furlough scheme on overall employment.

0800 GMT – Italy Q2 final GDP figures

The preliminary report can be found

here. The final figures should reaffirm a solid bounce back in activity in Q2, setting the stage for more optimistic set of numbers to follow in Q3 amid the bustling summer in Europe.

0830 GMT – UK July mortgage approvals, credit conditions

Prior release can be found

here. A general read of mortgage activity and consumer credit in the UK economy, with the latter still working its way back towards pre-pandemic levels.

0900 GMT – Eurozone August preliminary CPI figures

Prior release can be found

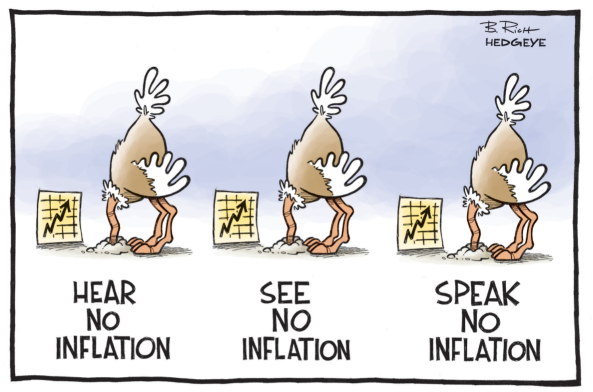

here. Euro area annual inflation is estimated to jump sharply this month, with higher figures anticipated across the region, driven by a multitude of factors from base effect adjustments (German VAT reduction in 2H 2020 and energy price developments) adding to rising cost pressures due to supply chain disruptions. Nonetheless, the ECB will continue to brush this aside but the pressure is certainly on.

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.